By Lizann Lightfoot, 2019 Armed Forces Insurance Coronado Naval Amphibious Base Spouse of the Year.

Renters insurance covers all the things you own inside a space that you are renting. Whether you’ve had a policy for years, or you’ve never given it a thought, here are the factoids most people don’t know about a renters insurance policy:

- You need it on base and off base: Renters insurance can be used everywhere—when renting an apartment off base, living in the barracks, or when staying in base housing. Yes, the property owner has insurance that covers the structure itself, but their insurance doesn’t include your personal belongings and won’t help you if anything is stolen or destroyed.

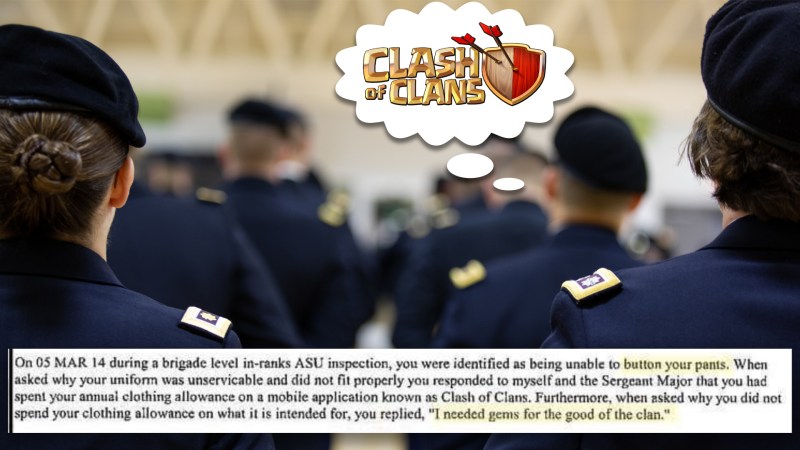

- It’s worth more than you think: Most people own more than they realize. The average two-bedroom rental contains more than $20,000 in personal possessions. Think about your electronics, your furniture, and yes—even all your military uniforms. If it would be financially difficult to replace all your belongings after theft or a fire, then you need renters’ insurance.

- You can take it with you when you move: Most renters insurance policies will cover your personal possessions during shipment or while in storage. Your policy covers your belongings, so even if you move three times in a year, put things in storage during a deployment, or PCS overseas, you are still covered. That’s some good peace of mind when you have no idea where the military will send you next.

- It protects you AND your neighbors: Renters insurance is all about you, and it covers more than just your belongings. In some cases, an apartment building might require you to carry renters insurance to cover any damage that you accidentally inflict on the rest of the building. Think about smoke or fire damage from a BBQ gone wrong: without renters insurance, you would be responsible for reimbursing the whole building for your mistake!

- It covers clumsiness: Renters insurance protects you from accidents that happen to you or your friends while inside your home. If anyone slips on your kitchen floor, fall on the stairs, or throws their controller through your TV (hey, it happens!) then renters insurance will cover those injuries and damages.

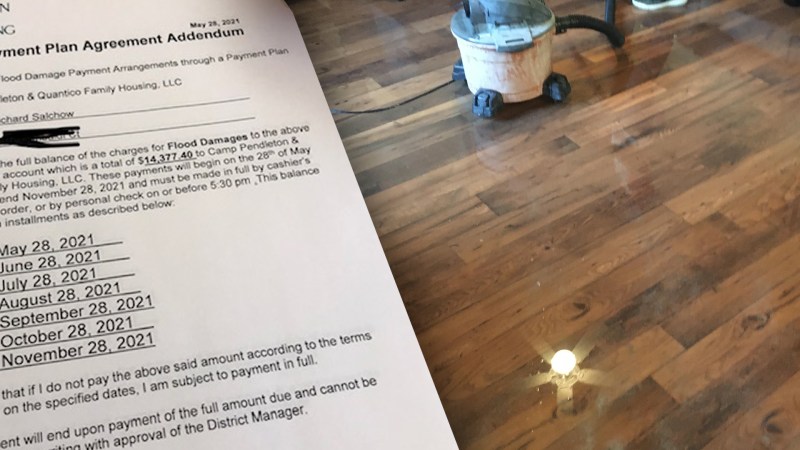

- BAH only includes partial coverage: You may have read that renters insurance is included in BAH, but that is only partially true. Yes, if you’re ‘renting’ from the military by paying BAH for government-owned housing, the military does provide some protection. However, there’s a catch: they set a limit for reimbursement, and that limit is usually much lower than the value of your items. Leave it to the government to cut corners, right? So if you want to be fully covered, you’ll need your own plan.

- It costs less than you think: You might not have renters insurance yet and don’t see a need for an added expense. I mean, who wants to pay an extra monthly bill, right? The good news is that a renters policy usually costs less than $20 bucks per month and less than $200 total for the year, but it can cover you for many thousands of dollars. That’s probably less than you’re paying for Netflix. And let’s be honest—renters insurance is going to be a lot more worthwhile than a season of Tiger King.

When you’re looking for an insurance company, it’s important to choose one that will work with your military lifestyle. Since 1887, Armed Forces Insurance has existed with a single purpose: To protect the people who protect our nation. For more than 130 years, AFI has provided military homeowner insurance, military renter insurance, and so much more. Be sure to check them out for yourselves at www.afi.org.

If you’re ready to protect what’s yours and be covered during a variety of accidents, then you need a renters insurance policy today. Go to www.AFI.org now for more information on how they can find you the best policy.

This article is sponsored by Armed Forces Insurance.