USAA has paid off a Marine family’s debt to a private military housing company after a Task & Purpose report last week identified a potential “gap” in their insurance coverage that left them with a hefty $14,000 bill.

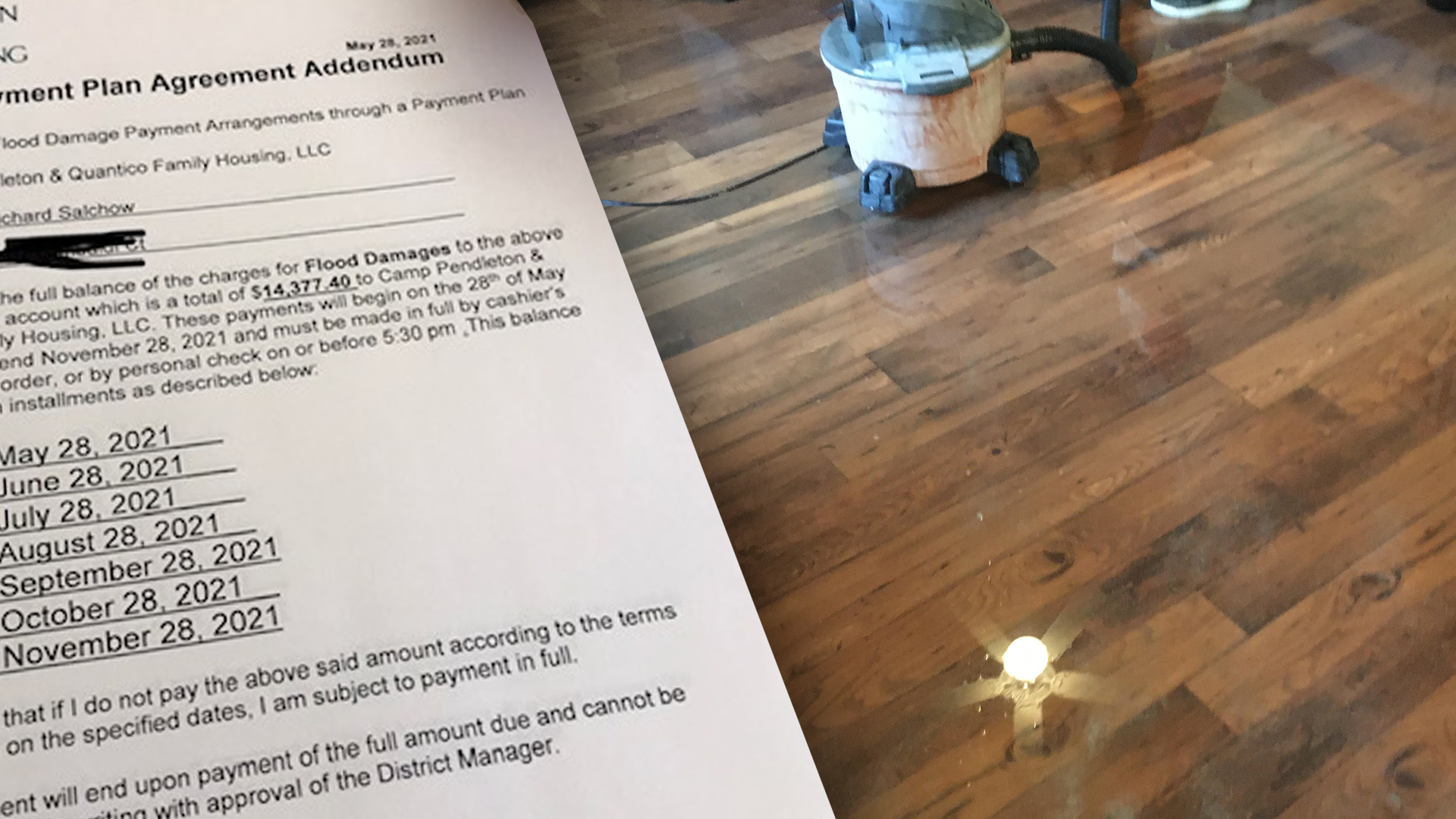

Maj. Richard Salchow and his wife Colleen were away from their home at Camp Pendleton, California, for about five hours on Jan. 16 when their floors were flooded. While running a load of laundry when they were out, the washing machine malfunctioned and left a quarter-inch of water on the first floor that affected the drywall and led to bubbles under the linoleum floors.

As Task & Purpose first reported on June 14, the Salchows thought their renter’s insurance policy with $100,000 in liability coverage would cover the repairs. But their insurance only applied to “government housing,” and despite living on base, the Salchows, like many military families these days, lived in what’s called a public-private venture: The federal government owns the land, but the house itself was leased by a private company which then rented to service members in exchange for their military housing allowance.

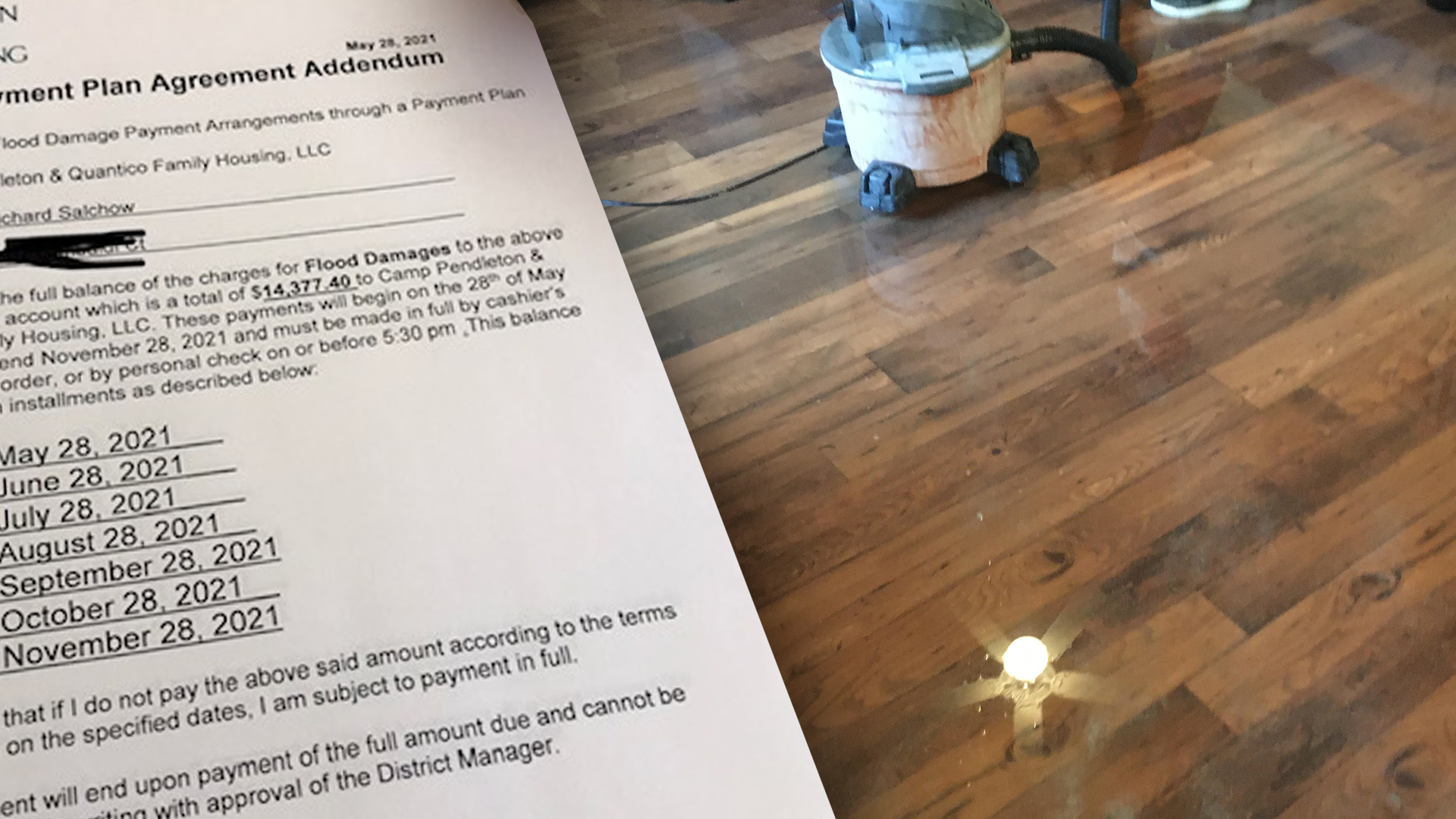

“I can honestly see no way we could have possibly planned for this scenario,” Colleen said of the situation in a Facebook post about their case, which caught the attention of the top brass at Camp Pendleton and beyond. After talking with advocates, other families, USAA and their landlord, Lincoln Military Housing, the Salchows found there was little more they could do and agreed to make payments of nearly $1,800 a month until November.

However, one day after news broke about their situation, the Salchows spoke with USAA Senior Vice President Debra Dunn, who agreed to pay the bill in full. They received a certified check from the company on June 18.

“Thank you to all of your team at USAA that worked on our case. We received the check yesterday, and Lincoln agreed to accept our full payment next week,” Colleen wrote Dunn in an email provided to Task & Purpose, adding that several military families asked if USAA would change their renter’s insurance policies in response.

“If there is any information I can pass to those individuals please let me know. Again, Richard and I are extremely grateful that USAA supported our family and went above the insurance industry standard.”

Dunn did not offer specifics in her response, but said the company was “continuously reviewing and innovating” its policies and helping members better understand their coverage.

“We very much appreciate your membership and your service to our country,” Dunn wrote. “I wish you and your family the very best.”

It’s not uncommon for military personnel to tell horror stories about base housing. Two military families, for example, filed a lawsuit against a private military housing company in March alleging that the homes they lived in had rampant mold problems, rodent infestations, and sewage leaks that led to health problems. The case is still pending.

And as a special report from Reuters found in 2018, thousands of military families in privatized military housing had been subjected to “serious health and safety hazards” that included lead poisoning risk, pest infestations, and rampant mold, prompting the Defense Department to introduce the Tenant Bill of Rights.

“Overall, we received a lot of shocked responses from service members on social media,” Richard told Task & Purpose. “USAA sent the certified check exactly like Debra Dunn said she would, and we have already sent a check to LMH to close out our ledger. We look forward to putting this matter behind us and settling into our life here in South Carolina.”